- TAGS: Development

- Link Apartments

Focus on Opportunity Zones: Five Years of Opportunity Zone Investing

By Clark Spencer, Managing Director, Investments

Over the past five years, Grubb Properties has experienced notable growth, sustained through a worldwide pandemic, and is now set to make a deeper impact in Opportunity Zones (OZs) in high-growth and resilient markets across the United States. As we approach the end of the fundraising period for our Link Apartments Opportunity Zone REIT, we wanted to take a minute and look back at the accomplishments we’ve seen thus far and share what we see in the future.

When the OZ legislation was passed in 2017, our firm, like many others, thought long and hard about how we could capitalize on this program while furthering its intended purpose of encouraging investment in low-income neighborhoods and communities that historically have been overlooked and underinvested in. We feel this purpose aligns well with our Link Apartments℠ strategy, which seeks to provide essential housing aimed at individuals earning 60%-140% of the area’s median income. In fact, at the launch of the OZ program, we realized that 40% of our existing Link Apartments℠ portfolio was already in what became designated as OZs. The first Link Apartments℠ community we built sits in what is now an OZ, and we still own that property today, demonstrating the longevity and sincerity of our commitment.

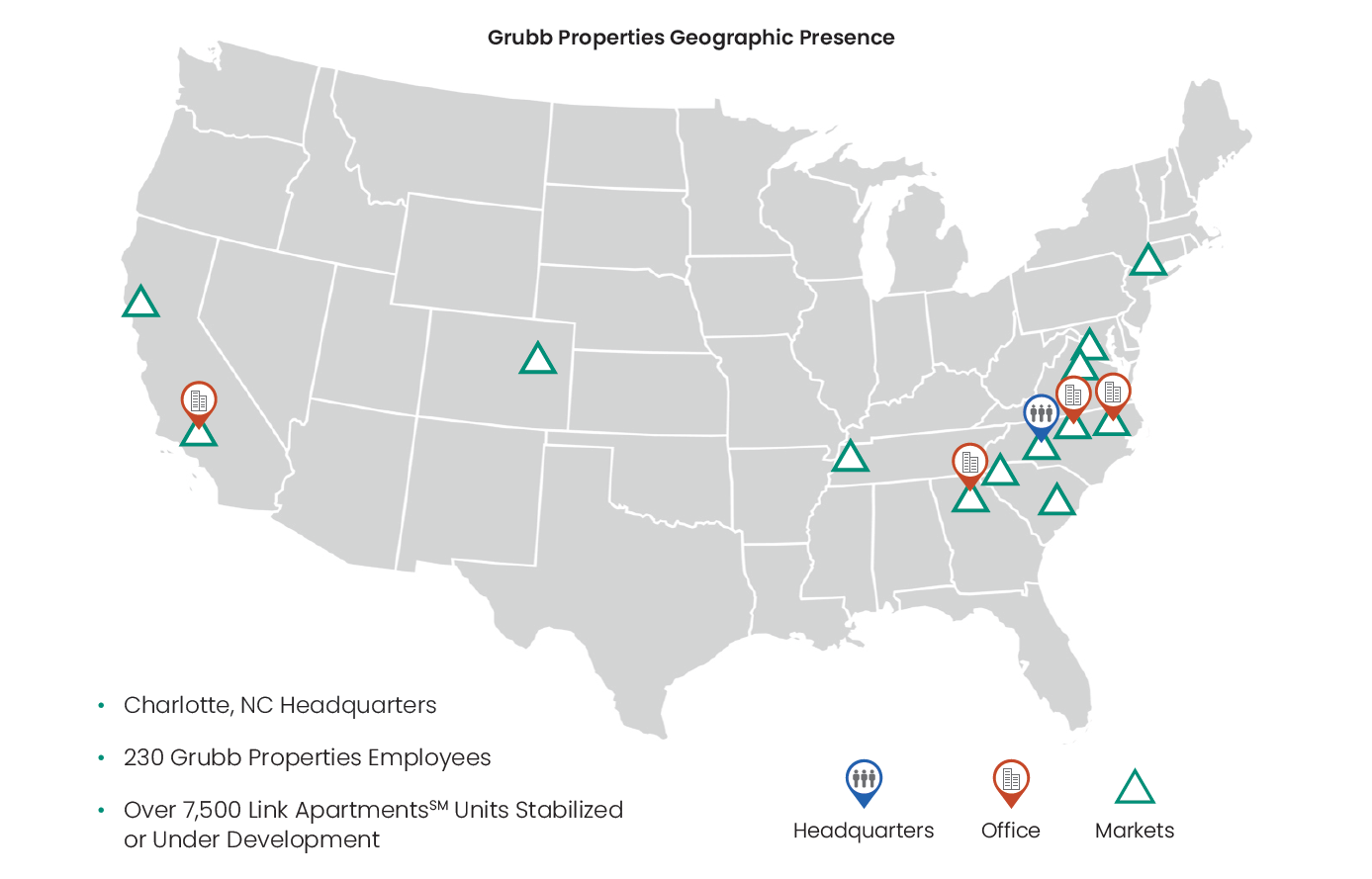

Guided by our corporate vision of “working together to make a meaningful impact on America’s housing crisis,” we have deployed over $550 million of capital into communities in North Carolina; Washington, DC; California; Colorado; New York; and Virginia. Our projects will provide communities with essential housing in areas where the housing affordability crisis is most apparent.

Our focus is on locations that are urban, transit-oriented, and close to major fixed employers such as universities and medical centers. Our Link Apartments Opportunity Zone REIT is projected to add 3,027 multifamily units (including ~2,500 by 2026) to the nation’s insufficient housing supply, all of which are meant to offer a more moderately priced option compared to competitors.

According to a study at the end of 2021, nearly half of American renters (49%) were cost burdened by high rents, meaning rental expenses took up 30% or more of total household income. Similarly, our recent 2023 Grubb Properties’ Young American Renter Survey, conducted in partnership with Wakefield Research, found that 78% of renters aged 22-35 had experienced a rent increase in the last year, and 90% of those planned to take or had already taken action to address those increases, with most taking multiple steps (see chart below).

While rental increases have cooled slightly, they are still significantly outpacing wage growth, and rent rates remain near record-high levels historically. Because of this economic environment and the 3.8 million housing shortfall, we see the need for essential housing continuing to increase over the next several years. Our goal is for our Link Apartments℠ brand to be a solution for many Americans that feel this burden. Across our entire portfolio, Grubb Properties has 9,500 units stabilized or in development and is on schedule to deliver six new projects in 2023. Our ultimate goal for Link Apartments℠ is to provide 28,000 units of supply to the market by 2028.

We also integrate environmental practices that make an impact, as 97% of our multifamily properties have either received a green certification or are pending certification. Our efficient model, which is based on six core floor plans, and the use of smart technology ensure our residents are able to save on utility costs, which makes a notable impact on their monthly budgets.

As a result, across our portfolio, Link Apartments℠ residents’ energy bills are on average 15% lower than they would be at comparable properties. In the owner-paid portions of the building, we average 24% less energy usage and spending than comparable properties in the local submarket. Building-wide, water usage is also a significant savings at 29% lower than at comparable properties. This strategy benefits the environment, eases living costs for our renters and supports the development of much-needed housing.

As one of the few vertically integrated operators investing at scale in OZs, we feel fortunate to be able to make a significant impact and be a financial steward to our investment partners. We see the future of the Link Apartments Opportunity Zone REIT continuing to add essential housing throughout urban America where demand is acute. This formula allows our investors to do well while doing good.

Read more about Opportunity Zone Investing here.

Clark Spencer

Managing Director, Investments

|

|