- TAGS: Link Apartments

- Perspective

60 Years and Growing: Essential Housing By The Numbers

The U.S. continues to face an unprecedented housing crisis as a shift in demographics and a lack of new construction exacerbate the imbalance between supply and demand. In less than a decade, a housing glut in 2011 became a housing crisis, with the current shortage estimated at a 3.8-million-unit shortfall (The Linneman Letter, Spring 2023).

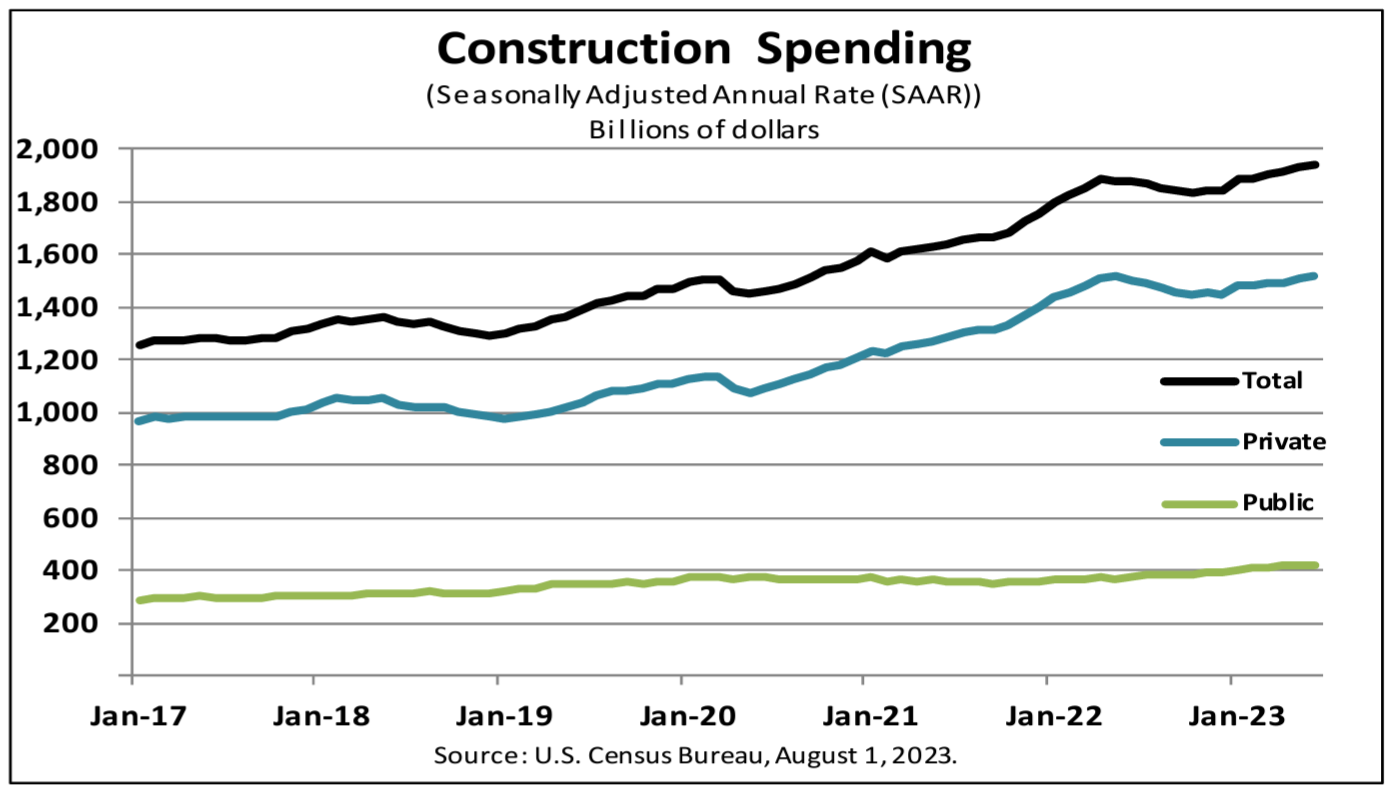

Inflation, rising interest rates, and lagging household incomes are intensifying this crisis in 2023. This economic environment will make it significantly harder for new product to get built, which will exacerbate the problem, and in turn will provide a premium for developers that understand how to build efficiently.

Responding to this shortage is at the heart of Grubb Properties’ development and investment strategy, executed primarily through our nationwide Link Apartments℠ brand.

For more than a decade, we have been developing a solution to the growing shortage of housing available for working professionals. As this shortage reaches crisis levels in the U.S., we are executing a strategy that has been sharpened and perfected through 60 years of experience.

The Housing Crisis: By The Numbers

The current housing shortage results from:

- Demographic shifts in population that aggravate demand

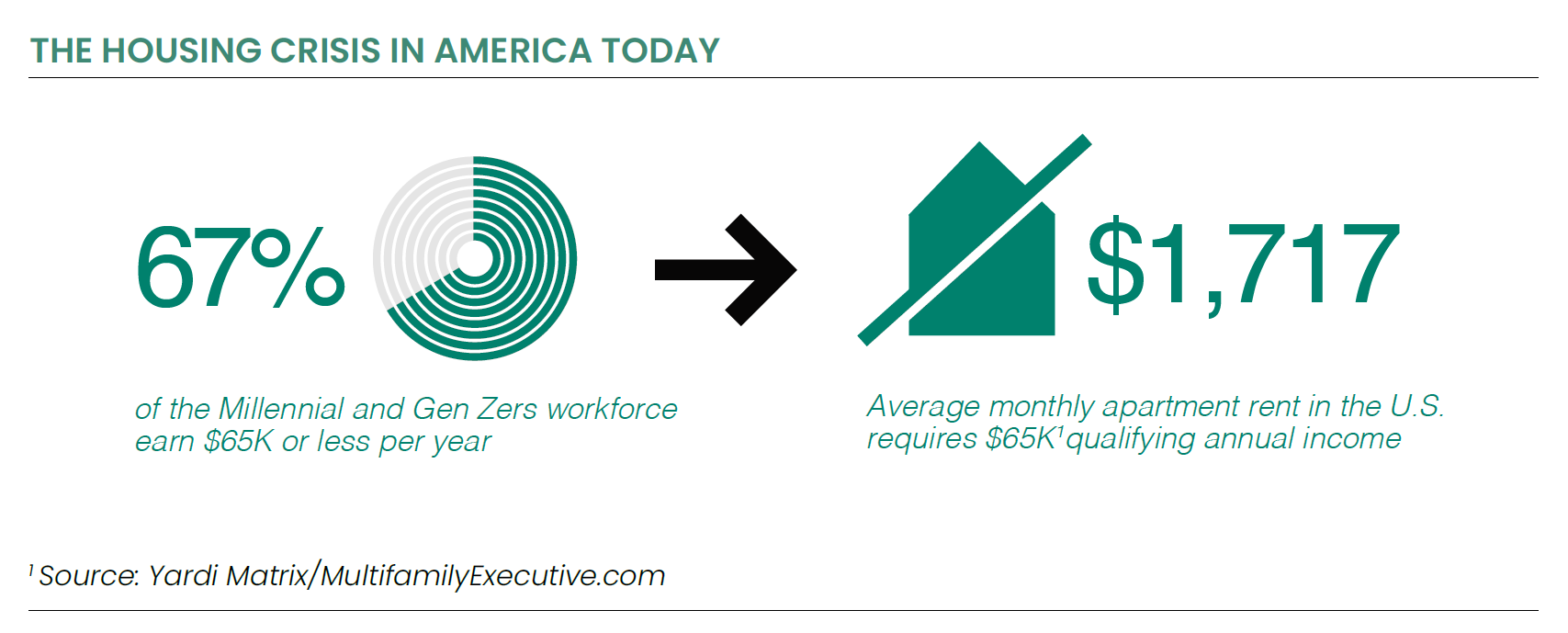

- Millennials and Gen Zers are a growing component of the workforce and require housing at a price point they can afford as 67% earn $65,000 or less per year (U.S. Census Bureau, 2021 Current Population Survey).

- 65.9% of all renters are 35 years old and under (PEW Research, “As national eviction ban expires, a look at who rents and who owns in the U.S.”).

- The average rental in the U.S. is at $1,717/month as of December 2022, and climbing, up from just $1,474/ month in July 2021.

- Evidence of pent-up demand

- 43% of adults aged 18-29 are living with one or both of their parents (Harvard JCHS, March 2021).

- The job market remains strong, with 1.6 million more jobs in the professional and business services sector than pre-pandemic levels (The Linneman Letter, Summer 2023).

- New housing supply at historic lows

- Now below 50-year historic average

- Underbuilding for more than 10 years

In 2023, the crisis is intensifying:

- 12.3 million American households were formed from January 2012 to June 2021, but just 7 million new single-family homes were built during that time (U.S. Census).

- Single-family home construction has been rising steadily since it bottomed out in 2009 during the Global Financial Crisis, but is actually running at the slowest pace since 1995 (U.S. Census).

Incomes are not keeping pace with rising housing costs due to student debt, inflation and other challenges:

- Building cost inflation has grown at a 10-year compounded rate of 4.5%, 41% more than wages (“Average Hourly Earnings,” Federal Reserve Economic Data, St. Louis, Federal Reserve Bank, March 2022).

- Building cost has outpaced wage growth by more than 1.4 times annually on average over the past nine years (Federal Reserve Economic Data).

- Millennials cannot afford the average U.S. rent as it is, yet much of the recent multifamily construction has been luxury apartments.

Increasing and persistent housing development challenges include:

- Rising construction costs: The national average cost of building an apartment went up by 17.5% year over year from 2020 to 2021, the largest spike in this data from year to year since 1970 (U.S. Census Bureau).

- While construction costs have come down from their peak and inflation has cooled, they remain elevated compared to pre-pandemic levels.

- Significant inflation: November 2022 had prices increase by 7.1% compared to November 2021. While the annual inflation rate has since cooled to 3.2% as of July 2023, the aftereffects remain (Consumer Price Index).

- Supply disruption: Slow delivery, product shortages, the pandemic impact and price increases only exacerbated the challenge (Matthew Vann, “What’s causing America’s massive supply-chain disruptions?” ABC News, October 15, 2021).

Click here to download the full anniversary publication, 60 Years and Growing.

|

|